According to Energy Security Analysts Inc. (ESAI) – an independent research firm that analyzes and forecasts physical and financial markets for petroleum, natural gas, power, and renewable energy – the U.S. could have a condensate surplus of as much as 200,000 barrel per day (b/d) in 2015 and that number could rise to 485,000 barrels per day by 2020.

Condensate is an ultra-light form of hydrocarbon liquid that is abundant in many shale plays across the country. It’s typically recovered from dissolved gas at the wellhead by field separators or natural gas plants. In its natural form, condensate is classified as crude oil, which under U.S. law cannot be exported.

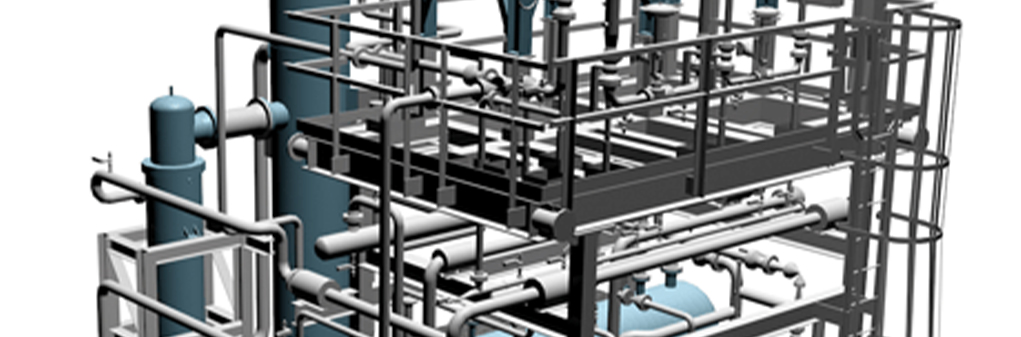

Splitters are distillation towers that provide a minimal level of processing to condensate, turning it into other products such as naptha (a commonly used petrochemical feedstock), which can be exported. The demand for splitters in the U.S. has risen dramatically in recent years as large volumes of light tight oil (LTO) have made their way from South Texas and North Dakota to the Gulf Coast – and that demand is expected to rise even further as producers try to navigate their way around the crude export ban to sell their product on international markets.

Early forecasts indicate that by 2017, global condensate production will outpace splitter demand. The Middle East is expected to add roughly 700,000 b/d of splitter capacity in the coming years, but those units will be used primarily for processing condensate that originates in that region. Many units are also set to come online in Asia and multiple splitter projects are currently underway in Corpus Christi and Houston as well. Condensate splitters typically represent an investment of about $200 million.